Despite the convenience of commission free brokerages, retail investors are still hitting a roadblock when it comes to participating in the stock market. I conducted a survey of 100 active investors, and the result showed that a lack of time to research stocks, insufficient funds, and limited knowledge are the top reasons preventing them from investing more frequently. These challenges represent the last mile of retail investing, a critical hurdle that keeps many people from participating in the market.

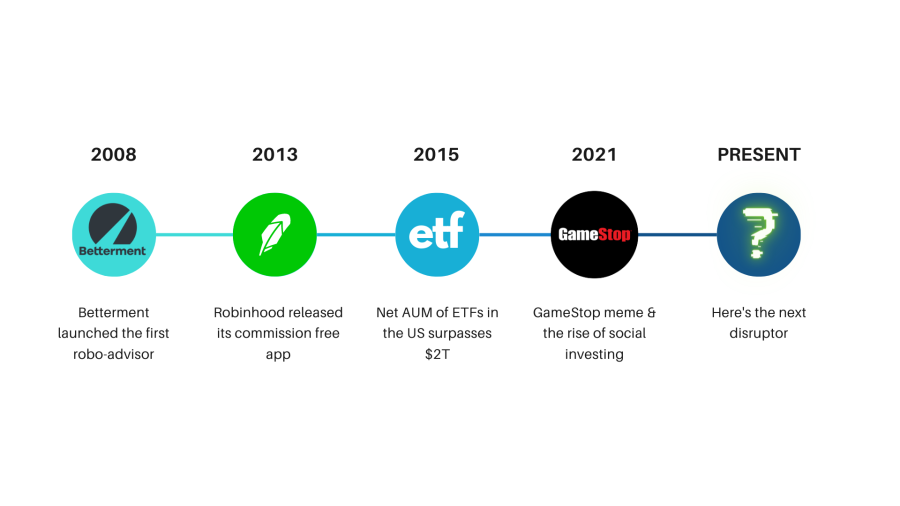

The Evolution of Retail Investing

Commission Free Trading: Robinhood revolutionized investing for Millennials and Gen Z, offering a user-friendly platform for easy and affordable stock market participation. The app’s commission-free trades and user-friendly design have shattered traditional barriers such as high fees and minimum requirements. This allows even novice investors to participate in the market.

Diversification: ETFs, or exchange-traded funds, have gained immense popularity in recent years as investors seek more efficient and diversified ways to invest in the stock market. These funds are similar to mutual funds, but trade on an exchange like a stock. The number of ETFs worldwide grew from 276 in 2003, up to 8,754 in 2022.

Lower management fees: Robo-advisors have disrupted traditional fund management by offering a low-cost alternative. Robo-advisors have made it easier for novice investors to access professional-level investment management services. Compared to traditional human advisors who charge a management fee of 1-2% per year, robo-advisors charge a fee of 0.25-0.5%, making them a more affordable option for investors.

Social investing: In recent years, there has been a rise in social/meme investing. This is characterized by individual investors using social media to discuss and promote certain stocks or investment ideas. This trend gained momentum during the pandemic and has continued to grow, fueled by Reddit and Twitter. This has led to the creation of new investing subcultures and has been credited with driving up the value of certain stocks, most notably GameStop and AMC.

Pandemic Spurs 10 Million New Retail Investors

According to a survey by Charles Schwab, a large portion of retail investors began investing during the COVID-19 pandemic. The survey found that 15% of new investors surveyed started investing in 2020, with 45% of them being millennials. The pandemic-induced market volatility, along with stimulus checks and increased time spent at home, encouraged many to enter the stock market. The survey also revealed that these new investors tend to be more engaged and trade more frequently than experienced investors. However, many also lack knowledge and experience and may need education and guidance to make informed investment decisions.

The Next Big Wave

In the next decade, a substantial transfer of wealth is expected as baby boomers pass their wealth to heirs. Estimates suggest that the total amount of wealth to be transferred could hit 84 trillion in just 10 years. This is due to an aging population and the relatively high levels of wealth held by baby boomers.

According to a study, 75% of heirs plan to fire their financial advisors the same day they receive their inheritance. This is largely due to a lack of connection and trust with the previous advisor, as well as a desire for a fresh start and a new perspective on their inherited wealth.

How to Attract Investors and Capture Trillions of Dollars in Wealth Transfer?

My survey revealed that people want to have some level of control over their investments. But the problem is, they can’t always do that when they invest in ETFs or Robo-advisors. Furthermore, many individuals don’t have the time to research individual stocks or a lot of money to invest.

Here’s how we can solve this last mile of retail investing: granting investors the option to select a theme, such as “renewables,” rather than individual stocks like Tesla. They can then invest in dollar amounts using dollar cost averaging, eliminating the need to concern themselves with the number of shares to purchase. This approach empowers investors to exercise greater control over their investments, without the requirement for extensive research or a significant upfront investment.

Companies to Keep an Eye On

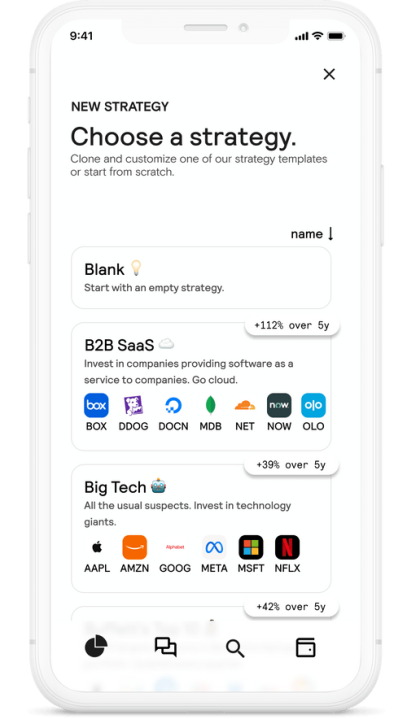

Public.com is a social investing app that aims to make the stock market more accessible and collaborative for all. With their new feature, Investment Plans, users can create baskets of stocks and set up recurring contributions. However, users are still responsible for researching and building their own baskets, which can be a tedious task.

Alinea is an investment platform that allows users to pick a premade basket, known as “playlist.” You can create, copy, or share playlists, fostering a social and collaborative investing experience. Although it is important to exercise caution to prevent inexperienced individuals from inadvertently influencing investment decisions.

Share Invest is a mobile and web app that empowers investors to pick premade themed baskets of stocks, known as “Strategies.” This frees investors from the hassle of individual stock research. With the option to set up recurring contributions as low as $5 per week, it’s like having a personalized piggy bank that aligns with your investment goals. As an SEC registered investment advisor, Share provides investors with added peace of mind.