For those involved in the IoT space, it feels as if not a day goes past without the launch of yet another IoT platform, promising a seamless conduit between connected devices and user applications.

Talk to any platform vendor and they’ll all earnest declare that their platform is the best, providing features and capabilities that exceed those of other platforms.

See also: IoT and dev platforms — connecting the world together

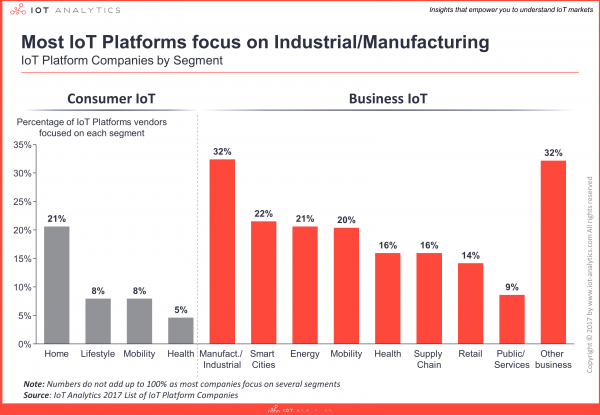

German research company IoT Analytics recently released its current Global IoT Platform Companies List. The database now includes 450 IoT Platform companies worldwide, which marks a 25% increase compared to the previous year. Of the 13 industries analyzed, most of the vendors now focus on supporting IoT Solutions in Industrial/Manufacturing (32%), Smart City (21%) and Smart Home verticals (21%).In previous lists, Smart Home had been the leading vertical.

How to choose a platform

For any prospective customer traversing the platform landscape, differentiating between the current 450 plus platforms on the market is a bewildering. To help, IoT Network recently launched IoT Pilot, a free, completely independent, analyst-driven tool designed to help enterprises navigate and evaluate the IoT platform landscape. It was created in conjunction with IoT research firm Beecham Research and I spoke to Saverio Romeo, their chief research officer to find out more.

He explained that Beecham Research had identified 25 key indicators against which to independently evaluate the performance of different IoT platforms. These include market experience, partnerships network, ease of use by system integrators, and advanced application development capabilities.

The consumer enters some information about their needs such as the purpose of the IoT device (for example, monitoring, predictive analytics and/or autonomous operability); the storage site of data (premises, cloud or hybrid location); and whether the vendor wants to integrate with existing workplace enterprise systems. A list of suggested platforms is generated with their key advantages detailed. Romeo explained that the purpose was to “provide a starting point for vendors to find a suitable IoT platform.”

A saturated market without a dominant player

Romeo noted that the challenge of finding an IoT platform was complex in a saturated market where there are currently no specific platforms dominating the market (as with iOS and Android in mobile). “Currently there’s no market leader creating one industry standard”. Rather there are small industry specific platforms, those that are specific to particular regions and those that focus on particular devices and functions. “Their difference might include security levels, their experience in the market or their level of support offered to clients.”

It’s a highly competitive space, Romeo noted:

“There are a good number of companies, specialized in a particular subsection of IoT or with specialized platform services such as prescriptive analytics. There will be some acquisition of smaller platforms by bigger ones but at the same time, I think the key issue here is being able to create the right ecosystem which is flexible enough to move you from being a player into system leader into several sectors. I think the management of ecosystems is really a challenging one but a key competitive asset in IoT.

Some people believe that the numbers will decrease we will end up with a small number of platforms able to do everything. But I’m not entirely convinced about that because of the context nature of IoT.”

Other focus areas for IoT analysis

The platform finder is really Beecham Research’s first foray into customer research with their target market typically vendors. Romeo sees many areas that need research and analysis:

“We need to understand more about the behavior of the network. If we have too many devices on the network we will start to feel the heaviness of all the devices on the network, so we will need to do network planning, we will probably need to prioritize traffic.”

Romeo also commented on two key complexities in the platform ecosystem: “Firstly, security. From a developer’s point of view, they say, ‘Somebody told me that I need to start using guidelines, but which ones? Who should I trust? The other one is the evolution of analytics and primarily the analytics at the edge. So how clever the edge device should be- and when?”

Romeo believes that data privacy and data ownership need to be discussed industry-wide, noting that the incoming General Data Protection Regulations (GDPR) in Europe do not fully touch IoT but offer some indicators. He also believes that device security needs to be viewed not only from the consumer perspective but also the greater ethical issues:

“The experience of explaining design innovation to engineers has been quite extraordinary over the last 10 years. I think the next step is to make them aware of how the stuff they do has a social impact. We see some of this emerging in the Horizon 2020 research program. There are a number of initiatives in which your organization can go basically and test the device from an ethical point of view, and so I think there is a move towards that.”

Anything that helps bring order, logic, and clarity of points of difference to the jumbled platform market can only be a good thing as the number of connected devices increases daily. It would be great to see other researchers provide their own similar pilots to enable the sector to have more independent analysis rather than self-regulation.

What platforms will survive in the next decade and which will fail? More than 30 of the companies included in the Global IoT Platform Companies List 2016 edition have ceased to exist-having either gone out of business or being acquired. Which kinds will become market leaders for specific use cases? These questions alone suggest that the IoT platform ecosphere may look very different in the future.