Retailers have to get with the times if they want to compete in the online marketplace. That means evolving to meet customer needs, managing change, and matching the pace of modern consumers. Luckily, there’s a whole world of IoT opportunities available to retailers. There are options for customer engagement, process optimization, and internal audit tools are diverse — and these impact the brick-and mortar retail experience.

That doesn’t mean there aren’t some growing pains. Lately, the rationale for coping with online retail has been all stick and precious little carrot.

Over 6,700 stores shut their doors for good last year, setting the all-time record for annual closings. As of this month, 14 retailers have filed for bankruptcy, and more than 1,700 stores have been slated for closure.

You’ll find a swath of doomsayers retweeting, blogging about, and struggling to explain these statistics, but one fact is undeniable: retail shopping and consumer behavior as we know them are coming to an end.

This trend is part of a culturally significant paradigm shift in global commerce, but it’s especially apparent in the United States.

The rapid exodus from department stores to online outlets is so dramatic that Bloomberg satirized the death of the American shopping mall with the development of a browser-based video game. The game is impossible to win, and the high scores are listed based on how long a player “survived.”

As you might have guessed, the predictions that this is the beginning of a “retail apocalypse” are only telling us half of the story.

While some retailers are pulling the plug across the board, others are closing stores and opening brand new locations simultaneously. For example, GAP, Inc. announced it plans to close 70 stores this year, but the company is also opening 90 new locations.

Walmart, despite closing 63 stores, is expected to open 90 shopping centers in new areas. While that doesn’t mean these retail brands are growing again—especially considering many former shopping mall titans are heavily in debt—it does mean that some major brands have yet to stagnate entirely.

In total, more than 1,500 stores are slated to open this year; compared to the 1,768 locations scheduled for closure, that’s a net decrease. However, you have to be mindful of sweeping closures due to bankruptcies in 2017. Much of these closures are due to liquidation from financial fallout, and, while impactful, don’t represent the retailers still battling for supremacy.

In stark contrast with this apparent downturn, reports from the U.S. Census Bureau, indicate that online sales account for just 10% of all purchases.

While this number includes purchases for less-tangible products like gasoline, the fact remains that brick-and-mortar brands are leading sales by a considerable margin.

While this confirms that traditional retail isn’t actually dying, some of the biggest brands are clearly hanging on by a thread. Unfortunately for the mallrat hotspots of yesterday, some business models simply aren’t cut out for the age of online shopping. Nevertheless, the survivors of this retail upheaval are destined to produce stronger business concepts and more sustainable go-to-market strategies because they weathered the storm.

Failure to Communicate

If you’ve read the tweets and blogs foretelling the “end of retail as we know it,” you could comfortably surmise that most consumers prefer shopping online. However, a 2017 Tulip Retail study on consumer preferences revealed that most (64%) consumers prefer to shop both on- and offline.

According to another report from SalesForce, 46% of shoppers still prefer to make their final purchase decision in-store — even if they started their product search online. So why is brick-and-mortar retail taking a nosedive if people are still dropping by in person?

The problem is that many retailers are struggling to properly implement multi-channel methods of engagement and revenue.

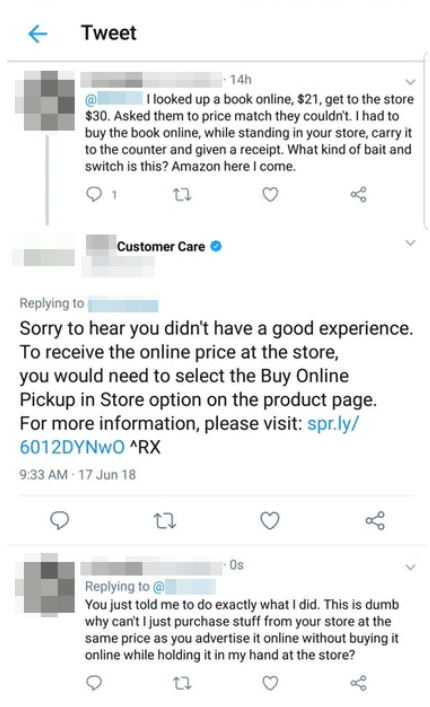

A whopping 83% of shoppers believe they know more about the products they’re looking for than store associates, and far too often that’s with good reason. Take a look at the screenshot below:

This customer is upset with a bookstore because a multi-channel purchasing disparity is making their shopping experience more difficult than it should be. They feel like they’ve been shortchanged and must jump through hoops to get a product as advertised.

Worse still, that experience led the customer to post their exchange on social media where it garnered hundreds of thousands of views in less than a week. That’s the last thing you want when you’re trying to cultivate a positive brand experience.

While this incident comes down to brand policy (and a broken policy, no less), it goes without saying that this “same result with extra steps” style of business drives sales to online alternatives — ones where customers feel like they’re in control. It’s little wonder why they believe they’re more aware of their options and the products they want than the store associates are.

In the age of IoT and social media, customer experience doesn’t happen in a vacuum.

If someone has a bad time at a branded store, everyone in their circle (and possibly the entire internet) is going to know about it.

According to a study from SalesForce last year, 55% of shoppers reported retail experiences were generally “disconnected” across channels.

Another 63% feel like the stores they shopped with “don’t really know them.” To handle this lack of consistency and engagement, brand evaluations need to carefully assess whether their in-store and online practices align — and whether those practices are trending better or worse for sales.

Brand compliance and consistency matter immeasurably to customers. To create a uniform brand image, a company needs to know what their processes look like from the inside and the outside. That kind of “self-awareness” starts with reliable data about what’s working, what isn’t, and what customers are saying about them.

Change Management and IoT Solutions

Software is springing up that incorporates blockchain for quality control in retail, while others are leveraging IoT solutions for supply chain management.

Some platforms, such as Form.com, integrate both of these functions with audits for compliance, customer experience, and long-term analytics. Thanks to these developments in digital retail auditing, IoT tools for management and business intelligence are increasingly shaping the way companies respond to gaps in their supply chains, as well as their public image and customer experience.

With properly implemented IoT tools, the above bookseller would’ve been able to note the online-offline discrepancy and instantly relay instructions on where and how correct it.

If employees weren’t appropriately trained to handle this customer’s concern, they could’ve been empowered and educated to make the right decisions through contextual training materials and on-the-spot coaching, all prompted by the app’s feedback.

Instead, they earned what we can safely assume is a very expensive blow to their PR. For retailers to evolve, they need to be willing to change old policies and implement new ones.

They need to offer reasonable, consistent experiences across all their markets. Neither of those will be possible without first taking a long, tough look in the mirror using smart data gathered with IoT tools.

That’s just the internal side of things. For customers, there are entirely new retail experiences available with mobile devices—some of which have retailers concerned.

One trend worrying brick-and-mortar brand is called “showrooming,” a practice which savvy consumers have engaged in for years but is quickly becoming the norm. Showrooming is the act of trying on or out products at a physical store while comparing store prices with online alternatives. Often, showroomers opt for the online option

Retailers are struggling to re-engage these showrooming customers and create a store experience that’s more than just another stop along the way to a final purchase.

For them, it may seem like there’s a delicate balance to strike when considering mobile apps: it appears to be a choice between engaging customers in-store and driving business out the door. If customers are only showing up to test a product in person so they can buy it cheaper online, why offer them an online (albeit branded) channel at all?

The truth is that mobile apps are the most powerful tools in their omnichannel marketing and revenue arsenal. Once just a simple way of offering in-store coupons and push notifications about sales, brand apps have become an indispensable means of keeping your customers in the store and engaged.

According to a study by Synchrony, 67% of consumers have downloaded a retail store’s mobile app. The same study reports that 71% of shoppers say they’re now using their mobile devices in-stores. For those companies who take advantage of both the online and traditional market, profits increase by up to 190%. On the surface, a mobile app may seem to cut into “IRL” shopping, but it ultimately yields much better sales.

Meanwhile, many retailers are trying to puzzle out what makes shopping “fun” in the first place: what makes shopping online so attractive to the average customer, and it is really more enjoyable than a trip to the local mall? It’s not simply the better prices (though that is a factor).

Perhaps it’s that consumers can spend hours a day browsing Amazon without buying anything, unmolested by store staff asking if they “need help finding anything.”

Maybe it’s the comfort factor. It’s the ability to lounge on your sofa, flicking through tens of thousands of products with the ease of a single swipe. In reality, it’s all of the above. Traditional retailers often get caught up on the idea that they need to compete with online prices, but it’s the online experience that has them on the ropes.

Consider the amount of effort that customers have to put in to achieve a good experience at a traditional retail store.

Customers don’t have to try to be engaged with Amazon because the online mega-seller does the work for them. One feature that highlights this form of passive engagement is Amazon’s recommendations system, which netted 29% increased sales the quarter it went live.

Although it’s practically common sense why function like this would drive such a high level of engagement, some retailers are still catching up to the idea that knowing your customers is the best way to cultivate loyalty. However, the facts speak for themselves: a 2016 Accenture report revealed that 75% of consumers were more likely to patronize a brand that recognizes them, recommends products based on previous purchases, and knows their purchase history.

Many retailers have begun to copy pages from the Amazon playbook. They’re using branded apps to not only offer online sales and promotions but to usher users into their stores.

Using a phone’s GPS location, a brand app can detect when a shopper is at or near a retail location and show push notifications for discounts and local offers. It can even prompt limited-time offers for that specific customer.

These apps are also able to track what consumers buy, recommend new items, and send notifications when something a customer might enjoy comes in stock. To entice consumers to make a stop at a nearby store, it can even offer time-limited coupons based on proximity. It can even note when a customer is at a competitor’s store— and offer a discount for similar products to their offerings.

While some consumers may not love the idea of being tracked by retail companies, even Amazon has yet to offer coupons to customers browsing in competitor’s stores. In this slim arena, adaptable and aggressive retailers are definitely trying everything to pull ahead.

Radical Ideas and the Retail Casualties

As Brendan Witcher, VP of Forrester Research, wrote last year, “In-store experiences haven’t changed substantively in over 100 years. Retailers who have failed at hyper-adapting to meet ever-changing customer expectations are now finding those same customers hyper-abandoning their brands.”

When you survey the mausoleum of store brands that are bankrupt or going out of business thanks to online retail, think about what they did to compete. Toys ‘R Us, Radioshack, Claire’s, Brookstone — these must-visits never quite managed to transcend their brick-and-mortar barrier.

Take Brookstone’s Kickstarter-esque “Maker’s Showcase,” for instance — a great idea, but too little too late.

Or consider how Radio Shack, despite needing to charge significantly more than competitors just to stay afloat, never diversified their stock and chose to remain a specialty store out of the mistaken belief that it would position them as area experts. Unfortunately for them, there’s only one proven method to compete with online retail: if you can’t beat them, join them.

According to Brendan Witcher, “The products don’t matter. The problem is that companies still think that the products that they carry matter. Consumers know that they can get a power drill at any one of a hundred places.”

Traditional retailers have to regard the showrooming and “just looking” crowd not just as dead weight in their store but opportunities to engage and delight. That doesn’t Apple should turn their Genius Bar into an actual bar, but some retailers are looking for ways to make their stores an all-in-one experience.

Instead of a high turnover methodology in which guests drop by to shop, purchase some items, and leave with a brand-bearing bag in hand, innovative retailers are experimenting with new ways to get customers to come in and stay put.

Take a look at the boutique listing for Urban Outfitters’ Space Ninety 8 in Williamsburg. It features an Israeli-style barbecue restaurant, a rotating tap of miniature pop-up shops, and even a rooftop bar. Grocery stores with restaurants have been drawing in busy Millenials for early adopters like Hy-Vee, which features bar with over 20 beers on tap.

Other concept shops, like the Roman and Williams Guild, buffer their household wares with fine dining, while IKEA’s famed meatballs (an in-store treat clinically proven to increase sales) are taking a slightly different turn at their test kitchen with insect-derived ingredients.

These attractions make not rake in revenue on their own, but they give shoppers a reason to walk in, enjoy the branded entertainment, and associate the value of their experience with the quality of the company.

The next time you go shopping for a new sweater, don’t be surprised if you’re offered a drink and a shawarma menu, too.

Conclusion

Cutting-edge retailers that push the boundaries of customer engagement will be increasingly popular in the coming years, and the retail market will be make-or-break for organizations still practicing static, analog approaches. But, the variables for failure or success aren’t hard to define.